- Not Uncertain

- Posts

- Next Warren Buffett > Inverse Jim Cramer

Next Warren Buffett > Inverse Jim Cramer

The next [something] is the first nothing

Eight billion: The world population now, the amount (in USD) crypto is trying to lose in a single day, and Mackenzie Bezos’ inflation-adjusted net worth after her next divorce. Let’s dive into this week’s big winners and bigger losers.

Bottom Line Up Front

Contribute something new to the news you’ll coffee chat over

Investors have leveled up how to make money off the World Cup, starting later this month. It includes correctly predicting surprise defeats for European nations and shorting their small-cap stocks ahead of time.

Nike is opening an online store and trading platform for virtual sneakers as it continues to pump investment into the metaverse. So if you’re a board member’s financial advisor, expect a question on why they’re not seeing “FB” in their top holdings.

Tyson Food’s new CFO made an appearance on the US meat giant’s earnings call yesterday – eight days after his arrest in Arkansas for public intoxication and criminal trespassing.

But first, a quick note from The Information.

If you're looking for high quality tech / VC reporting beyond TechCrunch and The Verge, I highly recommend signing up for The Information, where they get a lot of exclusives on major VC fundraises, startup funding rounds, and layoffs. They also have detailed company org charts for those who are looking to breakdown major tech firm corporate structures. Sign up here.

Deep Dive: The Buffett Curse

Being titled the next Warren Buffett gives you about as much luck as Jim Cramer going long your stock. So for the one piece you read this week that isn’t about Elon or crypto, let’s dive into the one investor who delivered what the WSJ called “Buffett-beating” returns…until this year.

Barry Diller lasted just three weeks at UCLA in 1961 before dropping out. He then worked his way up from the mailroom of William Morris to the CEO position at Paramount. But after nearly two decades as a hot shot “media executive,” he decided it was time for a change. Diller set out on a cross-country trip to do what we’d now call “finding himself,” equipped with his Macintosh PowerBook.

Barry Diller's one big idea arrived in 1992.

Diller visited MIT and Microsoft as part of his “cash out” tour, developing a theory of the future that included the advent of direct-to-consumer entertainment. Diller had come to understand, viewers will eventually receive video on demand, and more importantly, be able to watch what they want when they want. He originally likened this to a “video jukebox.”

Diller was a typical entrepreneur today. Most want to build the “next” [S&P name] rather than the “first” original idea. His later wife, Diane von Fürstenberg, hand-fed him this originality. In 1992, DVF visited QVC and watched soap stars sell over $450k in a single hour.

Diller had found his next move. It became the guiding principle for his career: "Interactivity." He wanted a communion between media and the consumer. That same year, Diller bought a $25 million share in QVC, selling his stake three years later for $130 million.

It was the end of an era but the beginning of a new one: InterActiveCorp.

Armed behind his new company, Diller went after the next best thing after QVC: the Home Shopping Network (HSN).

In 1995, Diller snapped up 20% equity (and 70% of voting control) of Silver King, a collection of twelve local TV stations. At the time of the acquisition, HSN operated as an independent entity after having been spun-off in 1992. That didn’t fly for Diller, who soon brought HSN back to Silver King in 1996. He gave the reunited company HSN's name.

Diller’s playbook seemed so predictable you’d think he didn’t have one. From the outside, he was leveraging his television experience to create a modern network to rival ABC, NBC or Fox. It took until the following year to see that something different might be going on.

In 1997, the reformed HSN acquired a controlling stake in Ticketmaster, the local event ticketing platform. HSN purchased the outstanding shares the next year.

The Ticketmaster acquisition set off a wave of acquisitions that would define Diller’s playbook.

February 1998: HSN acquires the USA Network and Sci-Fi channel from Universal Studios.

September 1998: USA Networks merges Ticketmaster with CitySearch, a website offering tour guides of different metropolises.

December 1998: The reconfigured Ticketmaster-CitySearch hits the public markets, popping 350% on opening day.

April 1999: USA Networks acquires Hotel Reservation Network (later to become Hotels.com).

May 1999: Ticketmaster steals Match.com from Cendant Corporation for just $50 million.

July 2001: USA Networks establishes a controlling interest in Expedia, intending to combine it with Hotel Reservations Networks. Diller's head of M&A and future Uber CEO, Dara Khosrowshahi, spearheads the deal.

May 2002: Diller grabs Interval International, a provisioner of timeshare services, for $578 million.

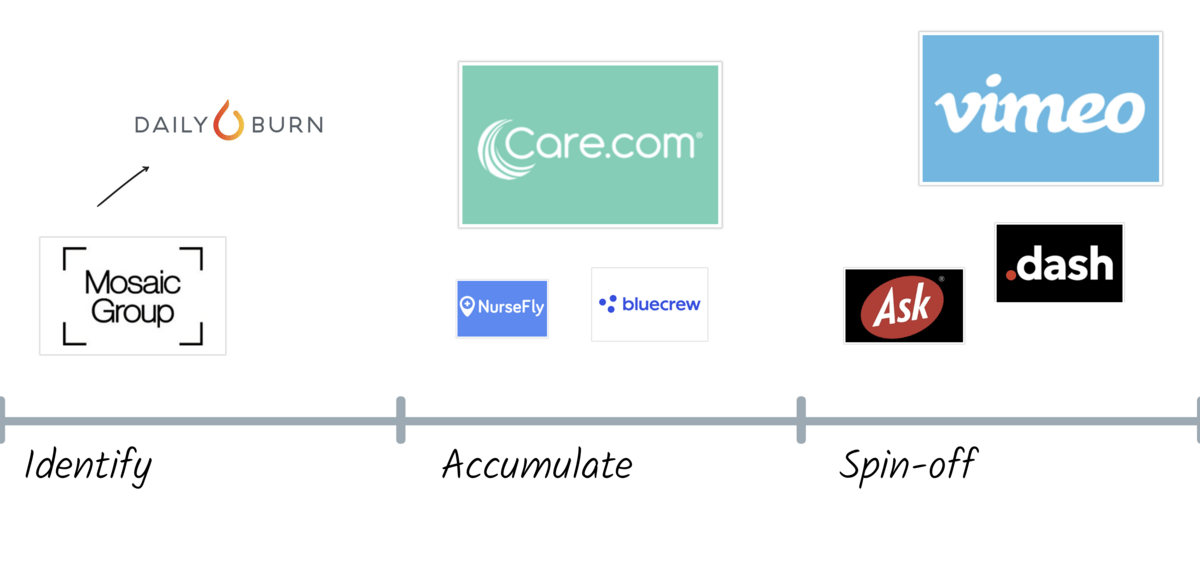

Diller had seemingly mastered the art of the acquisition. He spent the 2000s perfecting the spin-off. After being bulked up by the holdings above, Expedia emerged as an independent, publicly-traded company in 2005. LendingTree, Interval International, and even HSN also spun out.

To justify the steady stream of entrants and exits, Diller called IAC an "anti-conglomerate." In other words, a collection of businesses not meant to stay together but split apart.

Diller’s free reign came to an end with the 2007 economy. Over the year, IAC's stock fell 44%, while the S&P 500 rose 54%. Diller needed to build an explicit structure to his instinctive deal-making. In this reorganization, Diller split IAC into five companies, each with different focuses. IAC itself was, albeit vaguely, sub-divided into three separate business lines: "Media & Advertising," "Emerging Businesses," and "investments."

The Playbook - Turning $250M Into $60B

Diller’s spin-out strategy was worth the heart palpitations. When Diller took over Silver King in 1995, it was worth ~$250 million. A quarter century later, that company — now InterActiveCorp — has created an equity value of $60 billion, spread over ten publicly traded companies.

So just how much value has IAC created for its stockholders?

Over the last twenty-five years, IAC has undergone numerous stock splits, reverse splits and spin-offs. Some spin-offs were later acquired by other companies, or created sub-spin-offs of their own.

Starting with Diller assuming control of the company in 1995, shareholder total return can be assessed based on the following timeline:

1995: Diller named Chairman and CEO of Silver King Communications. The stock surges 50% to $39 on news of his appointment.

1998: 2-for-1 stock split

2000: 2-for-1 stock split

2005: Expedia spin-off

2008: IAC split into five companies: IAC, Home Shopping Network (HSN), Interval Leisure (ILG), Ticketmaster (TKTM), and Lending Tree (TREE)

2009: Live Nation (LYV) merges with Ticketmaster.

2011: Expedia spins out TripAdvisor (TRIP).

2017: QVC merges with HSN.

2018: Marriott Vacations acquires ILG.

2020: Match Group spin-off

If an investor bought one share of IAC (Silver King) in 1995 at $39 a share, as of the beginning of this year, they would now own the following assets:

1 share of IAC at $134

1 share of Expedia at $119

0.4 shares of QVC at $25

0.6 shares of Live Nation at $64

0.1 shares of Lending Tree at $312

0.2 shares of Match Group at $133

1 share of TripAdvisor at $25

0.7 shares of Marriott Vacations at $126

$5.90 in cash (ILG acquisition)

That adds up to an $717 in total asset value on a $39 initial investment.

Up to this year, Diller’s strategy has seen a 12% compound annual growth rate. Over the same period, the annual return of Warren Buffett’s Berkshire Hathaway was 10% and the S&P 500 index was 7%.

Shedding the Success

But this year was different. IAC has shed over 60% of its value this year amid the broad tech stock selloff. While Buffett leans heavily on household names like Coca-Cola, Diller has made IAC a success through a history of investing in underappreciated or misunderstood assets, often at particularly confounding times.

It’s when everyone is seeing confounding times that you’re able to differentiate the “next big thing” entrepreneurs from the genuine innovators.

Forecasts powered by Kalshi

As always, these market forecasts are powered by Kalshi, the first regulated prediction market in the US. Trust data, not pundits, and get your forecasts from people with real skin in the game.