- Not Uncertain

- Posts

- Powell Probes Goldman

Powell Probes Goldman

Your market recap, signals and noise

Good morning,

The US has reached its debt limit, Bank of America thinks recession fears have peaked, US existing-home sales dropped the most since 2008, and investors are holding near-record levels of cash.

Earnings season is entering one of its busiest weeks, with reports coming from some of the world’s largest companies. Meanwhile, global investment banking revenue sank to $15.3B in Q4, down more than 50% from a year earlier.

Let’s dive in.

But first, a message from today's partner, Kalshi.

Event contracts will ruin other forms of trading for you. Now that you’re finally able to trade directly on information you care about, you’ll never go back.

Will the Fed cut rates in 2023? What will CPI inflation be in January? Will your MD ever learn Excel VBA? Predict and profit from your answers over on Kalshi.

Eightball subscribers can see the markets and trade today here.

Bad News Dumpster Dive

Market movers like to bury bad news, so we've decided to excavate them. 👀 = degree of sus.

👀👀👀

Google layoffs to impact 12,000 jobs globally in 6% cut to workforce (Reuters)

The Federal Reserve is investigating Goldman Sachs’s consumer business (WSJ)

The CDC had significant influence over COVID moderation at Facebook and Instagram, receiving constant updates about which topics were trending, and giving recommendations on what content to flag as false or misleading (Facebook Files)

Elon Musk says he’s aware that after he tweets, Tesla stock moves up or down, but there is not a causal relationship (BBG)

Deutsche Bank cutting investment banker bonus pool by 40% (Reuters)

KKR limited withdrawals from a real estate investment trust after investors sought to pull out more money (BBG)

👀👀

Amazon is shutting down its charity program amid massive company-wide layoffs, claiming its "ability to have an impact was often spread too thin” (CNN)

More than half of German companies are currently reporting labor shortages (Reuters)

It’s revealed Genesis, founded by the Winklevoss twins, lost $1.2B in Three Arrows Capital and $175M in FTX. The news came after the crypto firm filed for Chapter 11 bankruptcy (Cameron Winklevoss)

Google usually pays employee year-end bonuses on time, but the company has decided to push back 20% of the bonus (CNBC)

Ripple CEO is optimistic that the crypto firm will get its ruling on its lawsuit soon, calling the SEC "embarrassing" (Cointelegraph)

Cardano’s co-founder, Charles Hoskinson, is considering buying crypto news service CoinDesk (Bitcoinist)

👀

The SEC charged Avraham Eisenberg with manipulating the Mango Markets “governance” token and stealing $116M (SEC)

Former FTX US president, Brett Harrison, raised $5M for another crypto startup called Architect (CoinDesk)

The SEC charges Caroline Ellison and Gary Wang for defrauding investors with FTX (Fortune)

Twitter has around 1,300 employees today, per CNBC, from 7,500 in November (CNBC)

Jamie Dimon of JPMorgan says rates will rise above 5% because there is still “a lot of underlying inflation” (Yahoo)

The price of a Manhattan apartment declined for the first time since early 2020, with the median price down 5.5% (CNBC)

US existing-home sales dropped 17.8% in 2022, the most since 2008 (AP)

Signal to Noise

Next week’s market outlook and whether you should actually care.

Signals

Noise

Signals

S&P U.S. Services PMI (1/24)

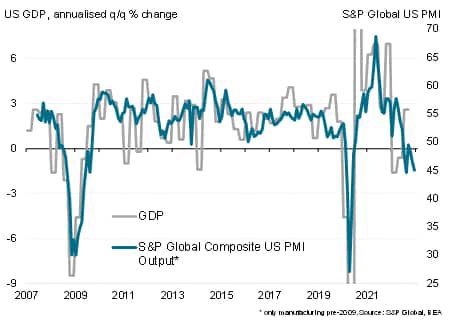

Amid speculation that the US could be slipping into a recession, upcoming flash PMI data will be eagerly assessed to gauge the business climate in the opening month of the year. S&P Global will release its Composite PMI for January on Tuesday, gauging business activity across the U.S.

The headline output number from the PMI survey is typically always the first port of call when assessing the current underlying economic climate, and the recent PMI data from S&P Global have been mostly gloomy. In December, the composite output index covering manufacturing and services hit the second-lowest since the global financial crisis if early pandemic lockdown months are excluded.

The PMI is an early warning indicator that all is not well in corporate America. Any further weakness in January would add fuel to recession worries. Another important aspect of the PMI surveys will be the inflation indicators. Markets currently anticipate that core PCE inflation for December will increase 0.25%.

Q4 GDP (1/26)

On Thursday, the Bureau of Economic Analysis (BEA) will issue the advance estimate for fourth-quarter gross domestic product (GDP).

The estimate tracks whether the U.S. economy expanded during the last three months of 2022. Markets project the U.S. economy grew 2.5% at a seasonally-adjusted annual rate, following a 3.2% expansion in the third quarter and after two consecutive quarterly declines in the first half of the year. Growth likely decelerated from the third quarter due to a slowdown in consumer spending, which accounts for nearly 70% of U.S. GDP.

December PCE Prices (1/27)

The BEA will release its Personal Consumption Expenditures (PCE) Price Index for December on Friday, providing the latest update on inflation.

For comparison, markets expect inflation to rise >0.1% in January (84% odds). PCE prices likely rose just 0.1% last month, down from 0.4% in November. On an annual basis, price growth likely decelerated to a rate of 5.1%, down from 5.5% in November and a recent peak of 7% in June. Core prices, which exclude food and energy costs, are projected to have risen 4.4% year-over-year, down from 4.7% in November.

A lower-than-expected reading could prompt the Fed to decide on a smaller interest rate hike of 25 basis points at the upcoming FOMC beginning on Jan. 31. It would also add to recent data showing consumer and producer prices decelerated in December, with the annual rate of consumer inflation falling to its lowest level in over a year.

Noise

Tech Earnings

Earnings season is kicking into high gear this week. It could be one of the busiest this earnings season, featuring reports from some of the world’s largest companies. Microsoft, Johnson & Johnson, Verizon, and Lockheed Martin will report earnings on Tuesday, followed by Tesla, AT&T, IBM, and Boeing on Wednesday. Thursday’s earnings lineup will include Visa, Mastercard, and Intel. The week will wrap up with earnings from Chevron and American Express on Friday.

Earnings projections for S&P 500 companies have improved slightly in recent weeks. But significant disinflation periods usually witness an earnings drawdown. Analysts now project three consecutive quarters of earnings declines extending into the second quarter of this year, with Q1 and Q2 earnings projected to fall 0.6% and 0.7% on an annual basis, respectively, before rebounding in the second half of 2023.

New Homes Sales (1/25)

This Wednesday’s latest updates on the housing market will include new and pending home sales for December.

For context, existing home sales dropped for the 11th straight month in December...leading to a record 34% drop year-over-year (worse than the worst drop during the Great Financial Crisis). That is the longest monthly streak of sales declines in history, which dragged the Existing Home Sales SAAR down to 4.02mm, its lowest since Nov 2010 (below the worst month of the COVID lockdowns).

Markets are 91% skeptical that the 30-year fixed rate mortgage will be over 5.9% by the end of the week – a steep drop from 6.1% last week.

Btw - a bonus from our partner The Information.

If you're looking for high quality tech / VC reporting beyond TechCrunch and The Verge, I highly recommend signing up for The Information, where they get a lot of exclusives on major VC fundraises, startup funding rounds, and layoffs. They also have detailed company org charts for those who are looking to breakdown major tech firm corporate structures. Sign up here.

Powered by Kalshi

As always, these market forecasts are powered by Kalshi, the first regulated prediction market in the US. Trust data, not pundits, and get your forecasts from people with real skin in the game.